This story is part of So Money (subscribe here), an online community dedicated to financial empowerment and advice, led by CNET Editor at Large and So Money podcast host Farnoosh Torabi.

What’s happening

As businesses face inflation, some are passing down increased costs to consumers with new fees at checkout.

Why it matters

With inflation up 8.3% annually, the latest round of merchant fees are adding to consumers’ wallet woes.

What it means for you

Knowing about these fees can help you manage your budget and make better buying decisions.

Many businesses across the US are tacking on new fees allegedly to offset the burden of inflation and supply chain shortages. Additional or increased merchant fees may be popping up on your next receipt — and you might not even notice them until you get your bill. These extra charges are adding a layer of financial shock at a time when inflation is already costing the average household $311 more dollars each month, according to economists at Moody’s Analytics.

“Most of the time we find out about these fees when it’s time to pay, not before,” Ashley Feinstein Gerstley, author of Financial Adulting, told me via email. “Because these fees really run the gamut, you never really know what you are going to get.”

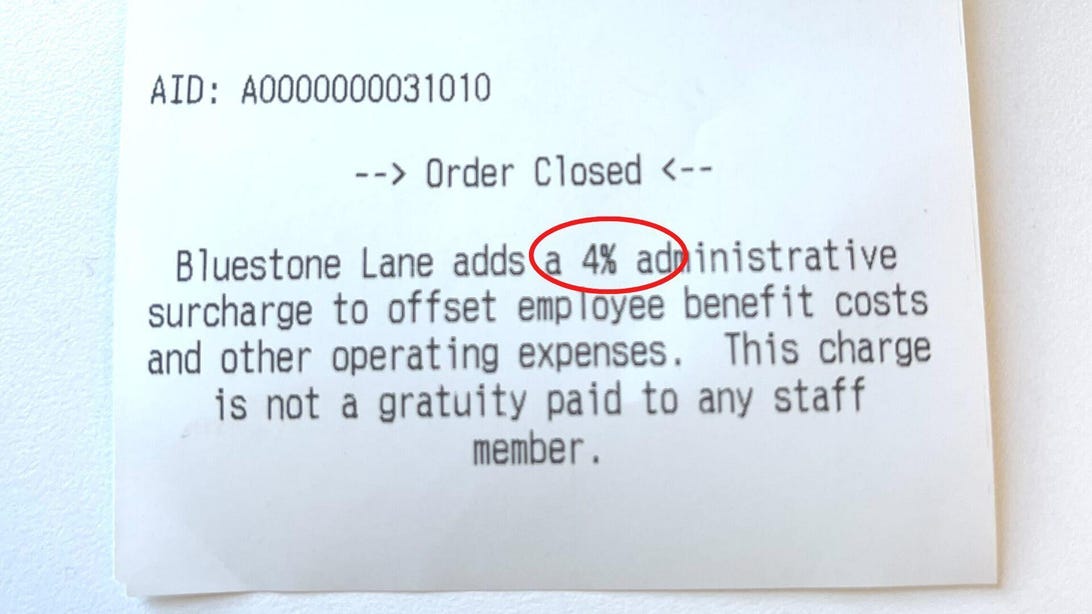

Look out for surcharges like these on your restaurant bills.

Courtney Johnston/CNETI asked my Instagram followers about these new and surprising fees, and they gave me loads of anecdotes. From restaurants to medical offices to rideshare services, here’s a look at some newer (or just surprising) charges that I’ve discovered. And I’ll offer tips on how to manage these unexpected surcharges.

Restaurants are charging more, and not just for food

Many restaurants are still reeling from a fiscal slump during the first year of the COVID-19 pandemic. Now, with rising food and payroll costs, eateries continue to struggle. “Average small business restaurants run on very tight margins of around 3 to 5% pre-tax,” said Hudson Riehle, senior vice president of research with the National Restaurant Association. “The typical restaurant business model is not set up to deal with this sustained and accelerated cost of food and labor, which is putting extraordinary pressure on operators, and indications are these will continue.”

Here are some of the new fees you may see on your restaurant bill:

Credit card surcharges

Earlier this spring, major credit card companies like Mastercard and Visa increased interchange fees, which is what merchants pay to card issuers every time a customer uses a credit card. Also known as “swipe fees,” they cost businesses 1.5 to 3% per transaction. They’re most challenging for smaller establishments like restaurants, and some are passing this expense on to customers as a percentage of their total bill.

When Feinstein Gerstley dined out with her family last summer in Sapphire, North Carolina, the restaurant charged a credit card processing fee that she says was not mentioned until the bill arrived: “We were a party of 15 who had drinks, apps, dinner and dessert so the charge was substantial, over $100.” Many states permit businesses to pass on their card swipe fees to customers, but they must properly disclose the surcharges on visible signage and their websites. The customer fee also cannot exceed what the business pays to the credit card companies.

Increased labor costs

Back in April, Sarah Morisson saw a $5 surcharge when the bill for her enchiladas arrived at a restaurant in Alpharetta, Georgia. The reason? “Increased labor costs.” This may also be called a “kitchen appreciation fee” in some eateries and comes in the form of an added $3 to $5.

Health care charges

Restaurants are competing for workers and offering more benefits as a draw. This added cost may show up on your receipt next time you eat out. In Chicago last month, Rema Shamon noticed a few dollars added to her dining bill labeled “health care for staff.” Similarly in West Hollywood, California, Claudia Scott was charged 3% more for “employee health insurance” at a local eatery.

Add-ons for staff who don’t get tips

At a sandwich shop in Portland, Maine, a couple weeks ago, Jennifer Steralacci and a friend paid a $4 fee “for non-tipped staff” — and that was on top of the gratuity. “I didn’t recall seeing anything on the menu that indicated this charge,” Steralacci told me.

Rideshare and food delivery apps are charging more for gas

Fees were already climbing because of the pandemic, but as rideshare companies compete to hire drivers, they’re luring them with sign-on bonuses and higher pay. That’s another reason your rideshare total seems more expensive than ever. On top of that, in March, Uber and Uber Eats announced a new fuel fee to help drivers cover the cost of rising energy prices.

That’ll cost an additional $0.45 or $0.55 on each Uber trip and either $0.35 or $0.45 on each Uber Eats food order, depending on the location. Uber says 100% of that fee goes to drivers. Rival rideshare company Lyft has also announced a 55-cent fuel surcharge. Grocery delivery app Instacart says it’s tacking on a new 40-cent fuel fee, too.

Fees at doctors’ offices are adding to the shock, too

Increased supply and materials fees

Keep an eye out for this line-item cost at your next medical visit, which ranges in price. In Dallas, Texas, Kelsie Whittington got hit with an unusual $18 “supply fee” after her son’s routine pediatrician visit in May. The medical office explained that it was for pricier bed covers, needles, gauze and other equipment.

With insurance companies slow to issue reimbursements, the clinic was having patients eat the cost. “I was a little shocked at first, then empathetic. I needed to pay for my son’s health,” Whittington said.

Facility fees

While doctors’ offices have been charging facility fees since before the pandemic, patients may not know about them until they receive an itemized bill. According to Consumer Reports, facility fees, which typically cover the cost of maintaining the medical office, urgent care center or clinic that’s owned by a hospital, can add hundreds of dollars to a bill… and insurance may only partially cover it.

What can you do about all the extra hidden charges?

To minimize the blow of these new fees and surcharges, we need to gather facts and be prepared to self-advocate. Here are four pieces of advice:

1. Question the fees: We may feel awkward or embarrassed to ask about new and unusual charges. But if a business is not upfront and hasn’t disclosed their charges ahead of time, it’s within our right to understand and ask questions. We may learn that the fee is justified and we’re actually happy to pay it and continue patronizing. In other cases, it may deter us from returning.

2. Ask for a cash discount: Like many gas stations, some restaurants offer cash discounts to help minimize their credit card processing costs. For example, at The Fifth Season restaurant in Port Washington, New York, cash-paying diners receive a 3.5% bill reduction through its Cash Discount Program promoted on the eatery’s website.

Even if not advertised, ask if a business will offer you a cash discount, a win-win for both you and the merchant. I’ve successfully used this trick at small, independently owned stores, too.

3. Think twice about using third party delivery apps: Delivery apps are convenient but they can quickly double the cost of your pizza order after fees, taxes and the suggested 25% tip. Ordering take-out the old-fashioned way by calling the restaurant directly could result in substantial savings. Some eateries may require you to pick up the food, but others may offer free delivery of their own — just be sure to tip the driver. If you want to stick with third party deliverers, MealMe helps identify the lowest options by comparing pricing across the board.

4. Vote with your feet: It’s our choice where and how to spend, and if paying extra fees is too much to bear, we have the right to walk away and patronize a different business next time. When a restaurant manager refused to remove the surprise credit card surcharge, Feinstein Gerstley said a family member in attendance shared the experience on Yelp. “We definitely didn’t return to the restaurant,” she said.

If a charge does not come with any adequate disclosure, the merchant may be in violation of state laws, so consumer advocates recommend filing a complaint with both your credit card issuer and the state attorney general. According to Riehle, “The restaurant industry is very competitive, and operators know that if a consumer’s last experience doesn’t meet their expectations, they are likely to vote with their feet.”